Understanding how siding affects home insurance premiums is crucial for making informed renovation decisions that protect both your property and wallet.

Your choice of siding material—from vinyl to metal to fiber cement—directly influences your insurance costs through factors like durability, fire resistance, and weather protection.

This guide looks at the connection between siding materials and insurance premiums, helping Naperville homeowners optimize their coverage while enhancing their home's protection and value.

Understanding how different siding materials influence insurance premiums helps homeowners make cost-effective home improvement decisions.

Insurance providers evaluate siding based on risk factors, durability, and maintenance requirements, with each material offering distinct characteristics that affect policy pricing.

Insurance premiums reflect material replacement costs, with more expensive materials like brick potentially increasing base costs but reducing overall premiums due to risk mitigation.

Impact-resistant siding certified against hail or wind damage can qualify homeowners for insurance credits. Research local insurer preferences before installation, as some Naperville providers offer better rates for specific materials.

Naperville's climate, which includes hail, thunderstorms, and seasonal temperature swings, demands siding that withstands local weather extremes. The durability and weather resistance of your siding directly correlate with the risk profile insurers assign to your property.

Choose certified weather-resistant siding tested for hail, wind, and moisture resistance. Schedule biannual siding checks before and after storm seasons, and replace damaged sections promptly to prevent small issues from escalating into major claims.

Fire resistance ratings directly affect vulnerability to fire damage, influencing insurer risk evaluations.

Siding materials are rated from Class A (highest resistance) to Class C, with brick and fiber cement typically achieving Class A ratings. Fire-resistant siding slows fire spread and reduces claim frequency, which insurers actively reward through premium discounts.

Energy-efficient siding also indirectly impacts premiums by reducing strain on HVAC systems and maintaining stable internal environments.

Insulated siding enhances energy conservation and often includes moisture barriers that prevent condensation buildup, lowering mold and structural damage risks. Some Naperville providers offer credits for homes with verified energy-efficient siding systems.

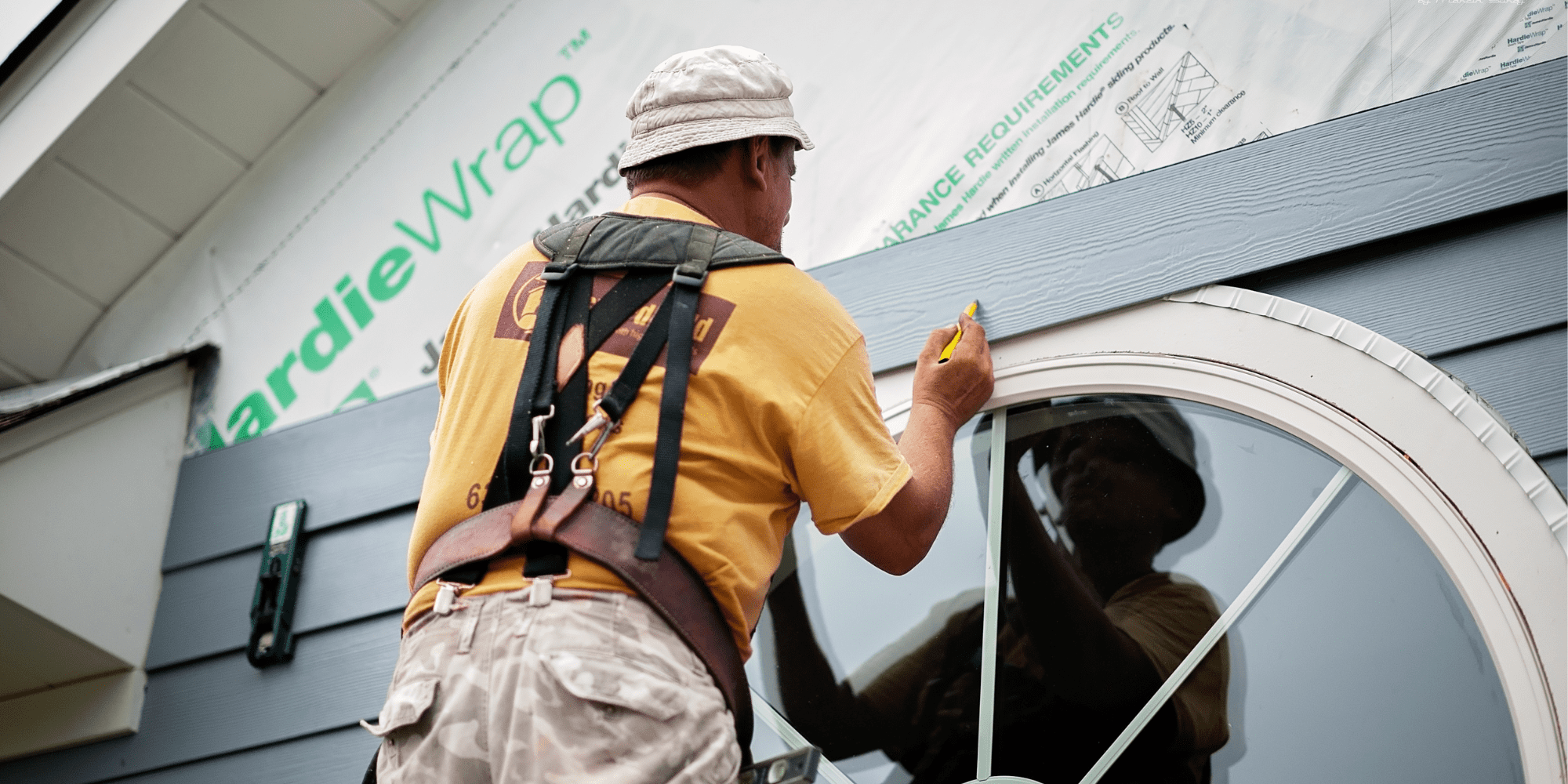

Combine fire-resistant upgrades with energy efficiency improvements, maintain documentation of certifications, and consult local fire authorities for code-compliant siding advice. Select materials, such as James Hardie siding, with verified insulation ratings that are recognized by insurers.

How you maintain your siding significantly impacts insurance premium calculations. Well-maintained siding signals reduced risks and can positively adjust insurance costs, while neglect may lead to claim denials or premium increases.

Regular cleaning prevents material degradation and allows easier insurer inspections. Routine inspections identify early damage before issues trigger claims, while seasonal maintenance preparations decrease weather vulnerability.

Proper repairs using professional services and appropriate materials ensure compliance with insurer requirements. Documenting maintenance activities proves proactive risk management and strengthens premium negotiations.

Naperville's specific weather risks include frequent hailstorms that can damage vulnerable siding like vinyl, seasonal temperature changes causing expansion and contraction, and high humidity increasing moisture risks.

Select impact-resistant materials certified for local weather conditions, implement weather stripping and sealants for enhanced protection, and follow recommended maintenance schedules.

Impact-resistant siding offers significant insurance advantages in Naperville's hail-prone environment. Materials undergo rigorous testing, such as UL 2218 for hail impact resistance, which insurers rely on to grant discounts.

Discount rates vary across insurers, so homeowners should shop around for optimal savings.

Proper documentation of siding improvements expedites claims processing and premium adjustments.

Comprehensive records, including receipts, manufacturer documentation, and contractor notes, provide clear proof to insurers. Photos before, during, and after upgrades validate work quality, while certification papers for fire, impact, and energy ratings prove discount eligibility.

Verify certification pre-installation to ensure insurer acceptance, combine with other storm-resistant upgrades for added premium cuts, and request insurer quote adjustments following installation.

Create a dedicated home improvement folder with all receipts, contracts, and photos, and use cloud storage for backup and easy sharing with insurers.

Deciding on siding upgrades requires balancing upfront costs with potential insurance savings and long-term value. Initial installation costs vary widely, from low-cost vinyl to expensive brick or fiber cement.

However, insurance premium savings from durable, fire-resistant, or impact-resistant materials often offset upgrade costs over time.

Increased home resale value adds financial incentives beyond insurance impacts, while maintenance savings reduce repair frequency and related claims.

Local Naperville incentives and rebates improve return on investment, and longer-lasting materials reduce replacement frequency.

Obtain multiple contractor quotes from reputable Naperville vendors, consult insurance agents on premium impacts before purchase, and investigate local rebate programs.

Factor in maintenance and repair savings alongside upfront expenses, and choose siding classes that optimize both rebate and insurance discount eligibility.

Effective communication with insurance adjusters during siding evaluations significantly impacts claim outcomes and premium revisions.

Prepare comprehensive documentation ahead of appraisals, including maintenance logs, certifications, and photos. Attend on-site inspections to highlight details and ask questions while providing detailed estimates from licensed contractors.

Higher-quality siding increases home market appeal and value, which intersects with insurance assessments. While premiums reflect replacement cost rather than market value, increased home value often correlates with higher rebuilding costs.

Update insurers promptly about siding improvements to ensure coverage matches enhanced value and prevent underinsurance.

Maintain detailed records of improvements and maintenance to support both value estimations and insurance underwriting. Consult appraisers when upgrading siding to ensure coverage matches improved home value, and use local market data to inform insurance discussions during policy renewals.

Understanding how siding affects home insurance premiums empowers you to make strategic material choices that reduce costs while enhancing protection.

By selecting durable, weather-resistant materials suited to Naperville's climate, maintaining proper documentation, and working proactively with insurance providers, you can achieve significant premium savings.

Remember that the right siding investment not only protects your home but also provides long-term financial benefits through reduced insurance costs and increased property value.

When you’re ready to replace your siding, choose SmardBuild, the top James Hardie Preferred Contractor in Naperville. Our commitment to innovation, quality craftsmanship, and superior customer service is at the heart of everything we do. Schedule your free initial consultation today!

Vinyl siding may slightly increase home insurance premiums compared to more durable materials like fiber cement or brick. While vinyl is affordable and low-maintenance, it's more susceptible to hail damage and wind, making it riskier for insurers. However, premium increases are typically modest compared to the material cost savings.

Homeowners' insurance typically covers siding replacement if damage results from covered perils like hail, wind, or fire. However, damage from normal wear, poor maintenance, or gradual deterioration usually isn't covered. Your policy's dwelling coverage limits and deductible will affect the payout amount.

Yes, siding significantly affects home value by improving curb appeal, energy efficiency, and buyer perception. Quality siding can increase home value by 2–5%, with newer, durable materials like fiber cement or stone providing the highest returns. Well-maintained siding also supports higher appraisals.

Fiber cement and brick/stone siding typically add the most value to homes. Fiber cement offers durability, low maintenance, and fire resistance while mimicking wood's appearance. Natural stone and brick provide premium appeal and longevity. These materials often recoup 70–80% of installation costs.